July 13, 2023

July 13, 2023

With almost 20 years of experience as a member and coordinator of a tobacco-free coalition, Sally Ancheta embarked on a new journey in 2022 as the East Hawai’i Drug-Free Coalition (EHDFC) Coordinator. In an interview, Sally shared her insights and experiences, shedding light on her transition and the transformative impact it has had on her approach to prevention.

Sally’s journey in this field began in 2003 when she joined a tobacco-free coalition. Seven years later, she assumed the role of coordinator and gained a wealth of knowledge about coalition building and tobacco control. During that time, the coalition did groundbreaking work around T21, which led to Hawaii becoming the first state to raise the age of sale of tobacco to 21.

However, when Sally transitioned into the role of Prevention Coordinator for EHDFC, she noticed distinctive differences in prevention approaches for other substances. “It wasn’t until I attended Mid-Year that I really understood the prevention framework and other coalition building tools that CADCA teaches,” explained Sally. “I almost feel like I’m starting all over again in my career, learning about this framework, conducting community needs assessments and building logic models and strategic plans.”

“One of the greatest things I saw at Mid-Year that I really loved and didn’t necessarily see as often in tobacco-free work, was the variety of partners in the room. During a breakout session of one of the workshops, you might find yourself in conversation with a Chief of Police, a pastor and people from all walks of prevention. Not everyone is simply focused on substance misuse, but also domestic violence prevention, harm reduction, and mental health.”

“Seeing this breadth of sector leaders in the room really clicked with me. One of the things I’ve learned this past year and a half as EHDFC’s Coordinator, is that if it’s not community-driven, then we shouldn’t be working on it. It’s not the coalition’s responsibility to tell the community what issues to focus on, but instead we should work with the community and take time to listen in order to shape our approach.”

Following her enlightening experience at Mid-Year, Sally became motivated to pursue further education and training. This past February, she attended CADCA’s National Leadership Forum and discovered an opportunity to continue her training through CADCA’s National Coalition Academy.

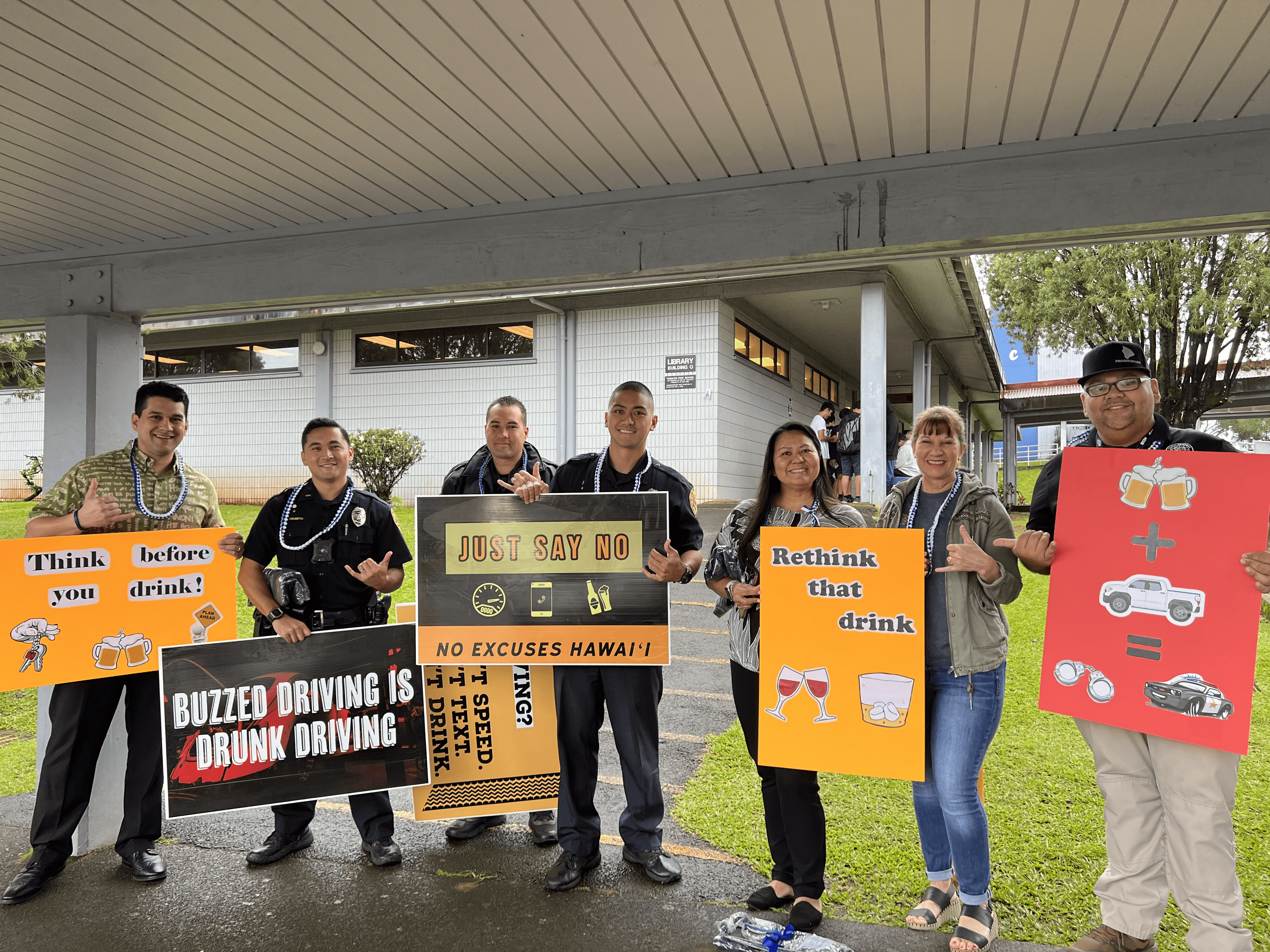

Now, armed with new knowledge, Sally recognizes the importance of understanding the unique, local challenges and equity issues surrounding substance misuse in her community. Alongside a group of dedicated coalition members, EHDFC has been working on conducting a comprehensive community needs assessment, engaging various stakeholders and coalition partners. This process involved conducting 80 one-on-one “talk story” sessions, where they listened to community concerns and gathered valuable data.

The community needs assessment allowed Sally and her coalition partners to identify the prevailing issues and concerns related to substance misuse, with a particular focus on underage drinking. By involving community members, including youth, in the assessment process, they aimed to foster a sense of ownership and inclusivity.

As Sally continues her work in substance misuse prevention, she envisions a future focused on community engagement and sustainability. She plans to organize town hall meetings to share the community needs assessment findings with the participants and ensure that the information gathered is returned to those who contributed. Additionally, to strengthen the EHDFC’s prevention efforts, Sally and her coalition are working to expand their membership and recruit partners from diverse sectors. Recently, they organized a two-day policy and action training, inviting both existing and potential coalition members to engage in meaningful discussions about health equity and alcohol-related harm in their communities, and in the future, they plan to host a retreat that focuses on prevention through an equity lens. This inclusive approach has resulted in a growth in coalition membership and paved the way for collaborative initiatives.

Sally’s transition from tobacco-focused prevention to substance misuse prevention has brought about a fresh perspective and a renewed commitment to community-driven efforts. Through her experiences, she’s learned the significance of a comprehensive community needs assessment, inclusive coalition building, and prevention strategies rooted in the community’s voice. Sally’s dedication to building partnerships, engaging diverse sectors, and leveraging data to drive impactful change exemplifies her commitment to making a lasting difference in her community.